Strategies here, strategies there, strategies everywhere..

Hello, blockchain adventurers and digital desperados! Today, we shall delve into the murky and magical waters of on-chain strategies. Hold onto your non-fungible hats, while we briefly go over just a couple popular DeFi Strategies!

In a world where digital assets are fast becoming the new gold rush, onchain strategies are the compass guiding prospectors through the blockchain wilderness.

Unlike the elusive X marks the spot on pirate maps, onchain strategies offer a dynamic blueprint, navigating through the cryptic terrain

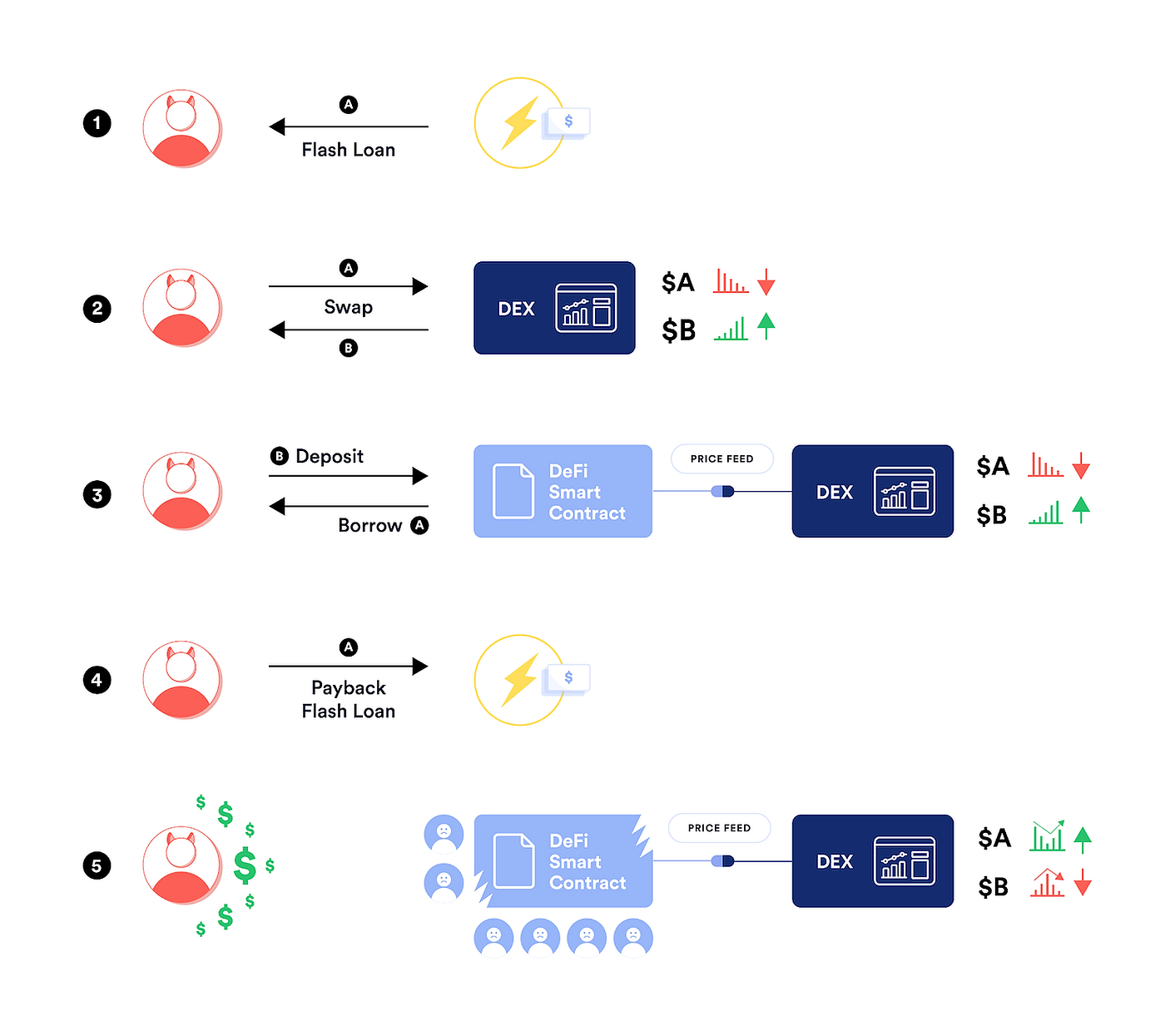

First on the list is Flash Loans.

The financial equivalent of a hit-and-run. In the decentraland, if you have the know-how, you can borrow heaps of crypto with no collateral, twirl it around for profit, and pay it back before the blockchain even knows what hit it.

In other words all actions are performed within the same transaction and if the loan is not returned at the end of it, its as of transaction never occurred in the first place! It’s the kind of financial wizardry that would make Wall Street stare with envy.

Flash loans have become a quintessential part of the decentralized finance (DeFi) landscape, providing unique avenues for arbitrage, liquidation, and other financial operations.

Below are just a couple of protocols known for facilitating flash loans:

Aave:

- Aave is a prominent, open-source, and non-custodial decentralized lending protocol. It’s known for its flash loans feature, which allows users to borrow assets without collateral, provided they return them within the same transaction. Aave has achieved notoriety for this feature, making it a significant player in the DeFi flash loan space.

dYdX:

- Initially following Aave’s lead, dYdX implemented flash loans, showcasing the versatility and innovative direction in which DeFi protocols are headed. This protocol has embraced flash loans to provide new opportunities and mechanisms in the decentralized financial ecosystem.

Fulcrum (bZx):

- Fulcrum, part of the bZx protocol, is another platform that has integrated flash loans. This protocol allows for margin trading and lending of crypto assets, with flash loans adding to the robustness and the allure of decentralized lending and borrowing solutions on the platform.

Uniswap:

- Uniswap, a decentralized exchange, facilitates flash loans through its UniswapV2 version. Here, lenders or liquidity providers supply liquidity to a pool, e.g., WETH/DAI pair, and users can access the available funds in the pool via flash loans. This feature enhances the borrowing and lending capabilities on the Uniswap platform, providing a fast, uncollateralized loan option for users.

These protocols exemplify the innovation and the variety of opportunities that flash loans bring to the DeFi space, each with its unique approach and features that contribute to the burgeoning flash loan ecosystem.

In the pulsating heart of decentralized finance, flash loans emerge as a marvel, a blitz of algorithmic agility.

With no collateral at stake, they dart through the blockchain, fuelling arbitrage, liquidations, and a myriad of other operations, all within a single transaction.

It’s the epitome of financial efficiency, a fleeting yet potent maneuver, embodying the innovative spirit of DeFi. Next up: Arbitrage

The ol’ buy low, sell high schtick, but with a blockchainy twist. In the fast-paced crypto corridors, price differences across exchanges are as common as Elon Musk tweets about Dogecoin. And with a dash of code and a pinch of timing, voila! You’ve skimmed the cream off the decentralized coffee.

Protocols like Uniswap, SushiSwap, and Balancer are often the playgrounds for such activities, where traders utilize smart contracts to swiftly execute arbitrage trades, bringing liquidity and price efficiency to the ecosystem.

In the buzzing marketplace of digital assets, arbitrage is like the cool cat that always lands on its feet, nimbly hopping across price gaps in various exchanges.

It’s the smooth operator in the bustling crowd, always spotting the chance to buy low here and sell high there, turning market inefficiencies into opportunities with a wink and a smile.

Now let’s stir in some Leverage.

This is where you put down some crypto, borrow more crypto against it, and then play the digital markets like a violin. If all goes well, you pay back the loan and pocket the profits. If not, well, let’s just say the blockchain will have its pound of digital flesh.

Now, wouldn’t it be grand if there was a magical digital wallet to simplify all these onchain shenanigans into a one-click wonder? Behold, our mystical creation — a wallet that’s your personal on-chain concierge.

With a click, it’ll flash loan, arbitrage, and leverage like a pro, all while you sit back and watch the blockchain chaos unfold from the comfort of your ergonomic gaming chair.

But wait, there’s more! We’ve seasoned this wallet with a dash of Account Abstraction and a sprinkle of Modularity.

Account Abstraction is like having a sleek, custom-tailored suit for your transactions, making them look good no matter where they go on the blockchain.

Modularity, on the other hand, is the Lego set of the crypto world. Don’t like a piece? Swap it out! Want to add some functionality? Snap in a new module! It’s all about making the blockchain bend to your whims and fancies.

So, to all the daring digital warriors out there, welcome to the era of Onchain Shenanigans.

With a trusty wallet by your side, the blockchain is not just your oyster, it’s your personal playground.

Register to receive an Early Bird Pass Follow our Twitter Join the conversation on Discord & Telegram

RELATED POSTS

View all